Economics explained

Category:

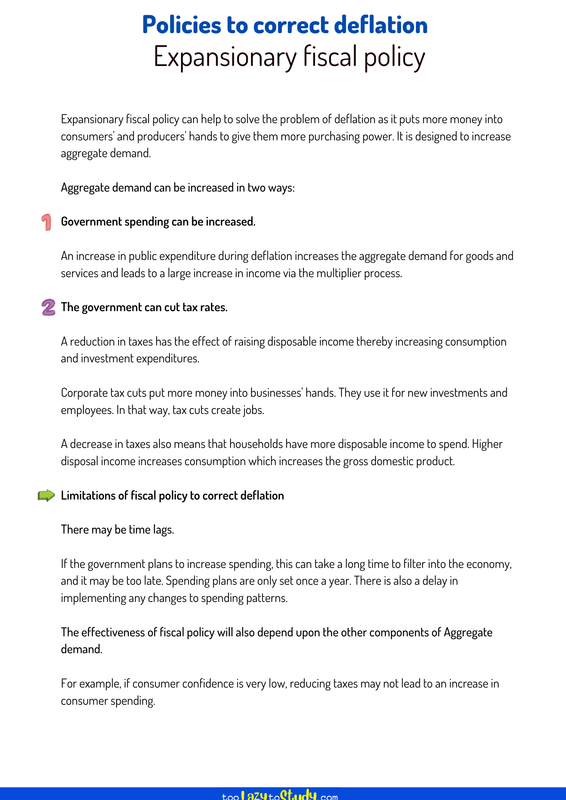

Policies to correct deflation

Fiscal policy

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

Expansionary fiscal policy can help to solve the problem of deflation as it puts more money into consumers' and producers' hands to give them more purchasing power. It is designed to increase aggregate demand.

Aggregate demand can be increased in two ways:

Government spending can be increased.

An increase in public expenditure during deflation increases the aggregate demand for goods and services and leads to a large increase in income via the multiplier process.

The government can cut tax rates.

A reduction in taxes has the effect of raising disposable income thereby increasing consumption and investment expenditures.

Corporate ta

x cuts put more money into businesses' hands. They use it for new investments and employees. In that way, tax cuts create jobs.

A decrease in taxes also means that households have more disposable income to spend. Higher disposal income increases consumption which increases the gross domestic product.

Limitations of fiscal policy to correct deflation

There may be time lags.

If the government plans to increase spending, this can take a long time to filter into the economy, and it may be too late. Spending plans are only set once a year. There is also a delay in implementing any changes to spending patterns.

The effectiveness of fiscal policy will also depend upon the other components of Aggregate demand.

For example, if consumer confidence is very low, reducing taxes may not lead to an increase in consumer spending.