Economics explained

Category:

Exchange rates

Fixed exchange rate pros and cons

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

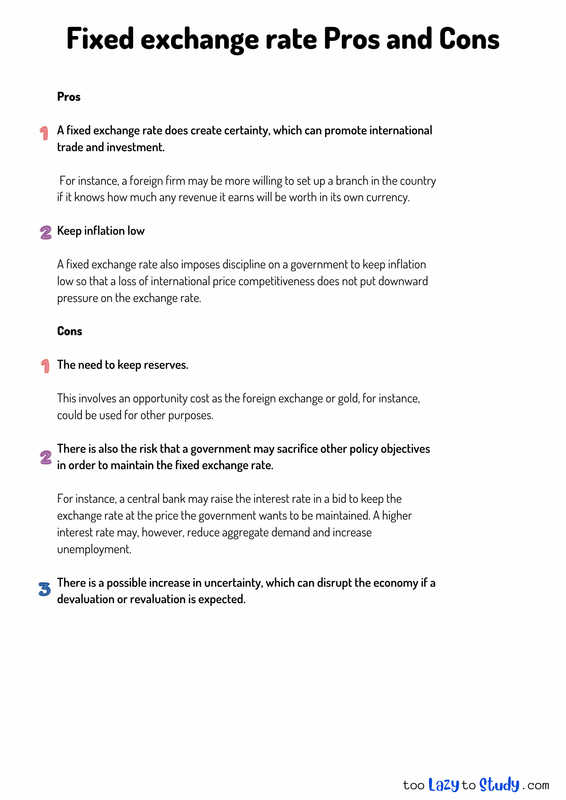

Pros

A fixed exchange rate does create certainty, which can promote international trade and investment.

For instance, a foreign firm may be more willing to set up a branch in the country if it knows how much any revenue it earns will be worth in its own currency.

Keep inflation low

A fixed exchange rate also imposes discipline on a government to keep inflation low so that a loss of international price competitiveness does not put downward pressure on the exchange rate.

Cons

The need to keep reserves.

This involves an opportunity cost as the foreign exchange or gold, for instance, could be used for other purposes.

There is also the risk that a government may sacrifice other policy objectives in order to maintain the fixed exchange rate.

For instance, a central bank may raise the interest rate in a bid to keep the exchange rate at the price the government wants to be maintained. A higher interest rate may, however, reduce aggregate demand and increase unemployment.

There is a possible increase in uncertainty, which can disrupt the economy if a devaluation or revaluation is expected.