Economics explained

Category:

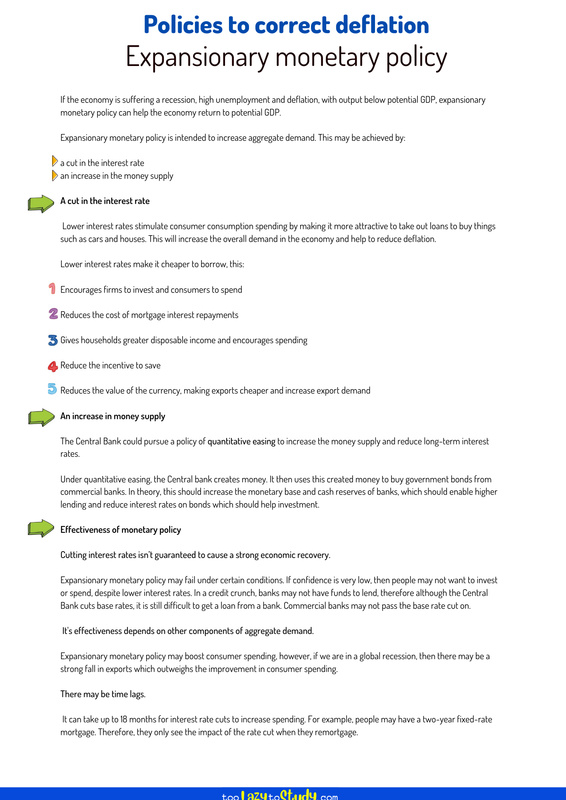

Policies to correct deflation

Monetary policy

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

If the economy is suffering a recession, high unemployment and deflation, with output below potential GDP, expansionary monetary policy can help the economy return to potential GDP.

Expansionary monetary policy is intended to increase aggregate demand. This may be achieved by:

a cut in the interest rate

an increase in the money supply

A cut in the interest rate

Lower interest rates stimulate consumer consumption spending by making it more attractive to take out loans to buy things such as cars and houses. This will increase the overall demand in the economy and help to reduce deflation.

Lower interest rates make it cheaper to borrow, this:

Encourages firms to invest and consumers to spend

Reduces the cost of mortgage interest repayments

Gives households greater disposable income and encourages spending

Reduce the incentive to save

Reduces the value of the currency, making exports cheaper and increase export demand

An increase in money supply

The Central Bank could pursue a policy of quantitative easing to increase the money supply and reduce long-term interest rates.

Under quantitative easing, the Central bank creates money. It then uses this created money to buy government bonds from commercial banks. In theory, this should increase the monetary base and cash reserves of banks, which should enable higher lending and reduce interest rates on bonds which should help investment.

Effectiveness of monetary policy

Cutting interest rates isn’t guaranteed to cause a strong economic recovery.

Expansionary monetary policy may fail under certain conditions. If confidence is very low, then people may not want to invest or spend, despite lower interest rates. In a credit crunch, banks may not have funds to lend, therefore although the Central Bank cuts base rates, it is still difficult to get a loan from a bank. Commercial banks may not pass the base rate cut on.

It's effectiveness depends on other components of aggregate demand.

Expansionary monetary policy may boost consumer spending, however, if we are in a global recession, then there may be a strong fall in exports which outweighs the improvement in consumer spending.

There may be time lags.

It can take up to 18 months for interest rate cuts to increase spending. For example, people may have a two-year fixed-rate mortgage. Therefore, they only see the impact of the rate cut when they remortgage.