Overview

Inflation is the name given to an increase in price levels generally. It is also manifest in the decline in the purchasing power of money

Inflation does not mean that the price of every good and service increases, but that on average the prices are rising.

Inflation reduces the value of money

Governments aim to control inflation because it reduces the value of money and the spending power of households, governments and firms.

Demand-pull inflation is caused by higher levels of aggregate demand driving up the general price level of goods and services.

Demand-pull inflation is shown by a rightward shift of the aggregate demand curve from AD to AD1.

How does demand-pull inflation happen?

If aggregate demand grows at a 4% annual rate but productive capacity grows at a 2.5% annual rate, enterprises will see demand surpass supply. As a result, they raise their pricing.

Furthermore, as enterprises produce more, they hire more workers, resulting in an increase in employment and a decrease in unemployment. This increasing demand for labour pushes up salaries, resulting in wage-push inflation. Wage increases enhance workers' disposable income, which leads to an increase in consumer expenditure.

Causes of demand-pull inflation

Lower interest rates. A reduction in interest rates leads to an increase in consumer expenditure and higher investment. This increase in demand leads to an increase in AD and inflationary pressures.

The increase in housing costs. Rising home prices have a positive wealth effect and increase consumer spending. As a result, economic growth accelerates.

Rising real wages. Unions, for example, bargaining for increased salary rates.

Devaluation. Exchange rate depreciation boosts domestic demand (exports cheaper, imports more expensive). Cost-push inflation will also result from devaluation (imports more expensive)

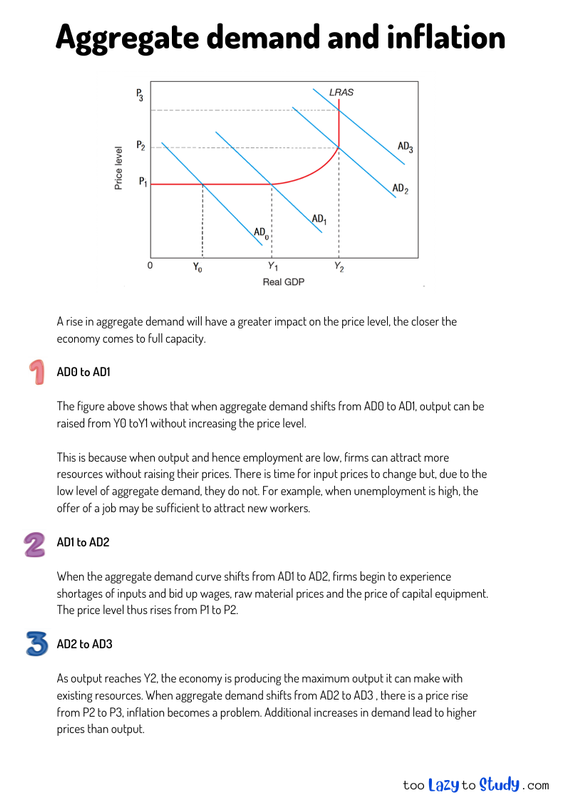

A rise in aggregate demand will have a greater impact on the price level, the closer the economy comes to full capacity.

AD0 to AD1

The figure above shows that when aggregate demand shifts from AD0 to AD1, output can be raised from Y0 toY1 without increasing the price level.

This is because when output and hence employment are low, firms can attract more resources without raising their prices. There is time for input prices to change but, due to the low level of aggregate demand, they do not. For example, when unemployment is high, the offer of a job may be sufficient to attract new workers.

AD1 to AD2

When the aggregate demand curve shifts from AD1 to AD2, firms begin to experience shortages of inputs and bid up wages, raw material prices and the price of capital equipment. The price level thus rises from P1 to P2.

AD2 to AD3

As output reaches Y2, the economy is producing the maximum output it can make with existing resources. When aggregate demand shifts from AD2 to AD3 , there is a price rise from P2 to P3, inflation becomes a problem. Additional increases in demand lead to higher prices than output.

.png)

Economics notes on

Aggregate demand and inflation

Perfect for A level, GCSEs and O levels!