Overview

Deflation

Deflation is defined as a persistent fall in the general price level of goods and services in the economy - in other words, the inflation rate is negative, for example, –3%.

It results in a rise in the value of money, with each currency unit having greater purchasing power.

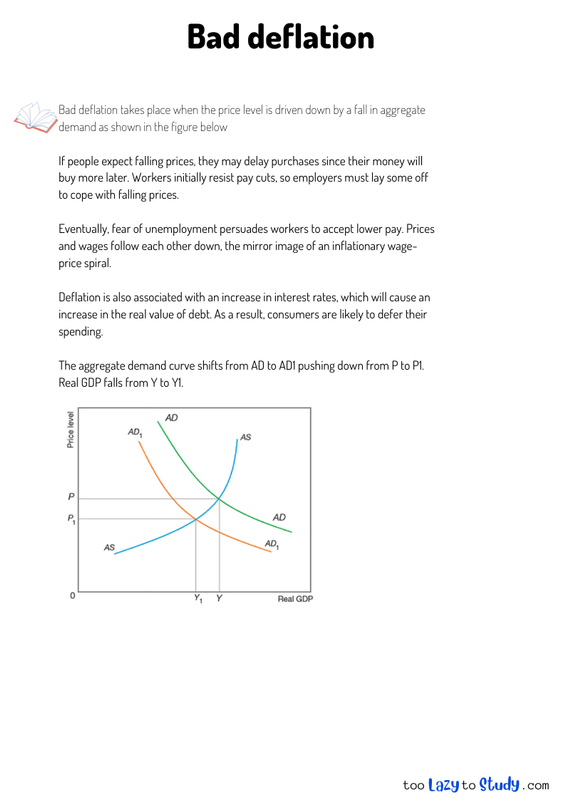

Bad deflation takes place when the price level is driven down by a fall in aggregate demand as shown in the figure below

If people expect falling prices, they may delay purchases since their money will buy more later. Workers initially resist pay cuts, so employers must lay some off to cope with falling prices.

Eventually, fear of unemployment persuades workers to accept lower pay. Prices and wages follow each other down, the mirror image of an inflationary wage-price spiral.

Deflation is also associated with an increase in interest rates, which will cause an increase in the real value of debt. As a result, consumers are likely to defer their spending.

The aggregate demand curve shifts from AD to AD1 pushing down from P to P1. Real GDP falls from Y to Y1.

.png)

Economics notes on

Bad deflation

Perfect for A level, GCSEs and O levels!