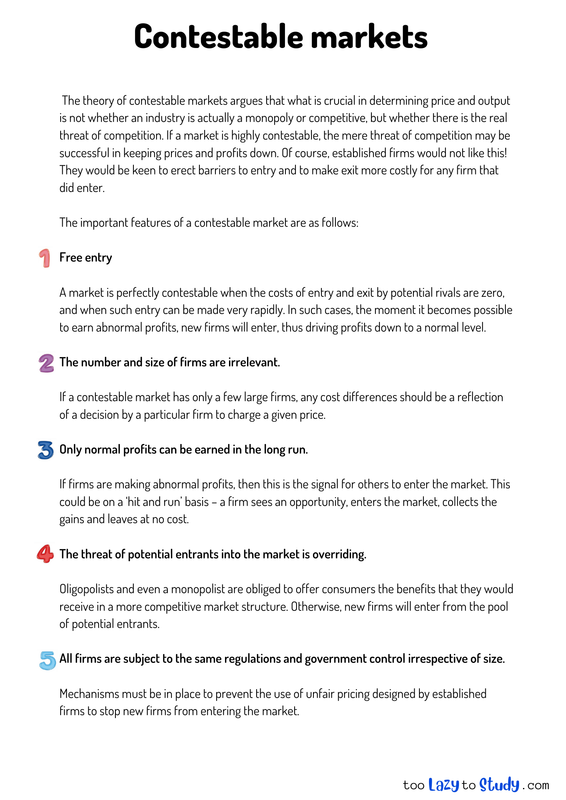

Overview

The theory of contestable markets argues that what is crucial in determining price and output is not whether an industry is actually a monopoly or competitive, but whether there is the real threat of competition. If a market is highly contestable, the mere threat of competition may be successful in keeping prices and profits down. Of course, established firms would not like this! They would be keen to erect barriers to entry and to make exit more costly for any firm that did enter.

The important features of a contestable market are as follows:

Free entry

A market is perfectly contestable when the costs of entry and exit by potential rivals are zero, and when such entry can be made very rapidly. In such cases, the moment it becomes possible to earn abnormal profits, new firms will enter, thus driving profits down to a normal level.

The number and size of firms are irrelevant.

If a contestable market has only a few large firms, any cost differences should be a reflection of a decision by a particular firm to charge a given price.

Only normal profits can be earned in the long run.

If firms are making abnormal profits, then this is the signal for others to enter the market. This could be on a ‘hit and run’ basis – a firm sees an opportunity, enters the market, collects the gains and leaves at no cost.

The threat of potential entrants into the market is overriding.

Oligopolists and even a monopolist are obliged to offer consumers the benefits that they would receive in a more competitive market structure. Otherwise, new firms will enter from the pool of potential entrants.

All firms are subject to the same regulations and government control irrespective of size.

Mechanisms must be in place to prevent the use of unfair pricing designed by established firms to stop new firms from entering the market.

.png)

Economics notes on

Contestable markets

Perfect for A level, GCSEs and O levels!