Overview

Inflation is the name given to an increase in price levels generally. It is also manifest in the decline in the purchasing power of money

Inflation does not mean that the price of every good and service increases, but that on average the prices are rising.

Inflation reduces the value of money

Governments aim to control inflation because it reduces the value of money and the spending power of households, governments and firms.

The consequences of inflation

A reduction in net exports:

If a country has a higher rate of inflation than its major trading partners, its exports will become relatively expensive and imports relatively cheap. As a result, the balance of trade will suffer, affecting employment in exporting industries and in industries producing import-substitutes. Eventually, the exchange rate will be affected.

An unplanned redistribution of income.

People on fixed incomes (such as students or pensioners) may find themselves worse off, as their income will not rise even though the cost of goods has increased.

If the rate of interest does not rise in line with inflation, borrowers will gain and lenders (savers) will lose. This is because borrowers will pay back less in real terms and lenders will receive less.

Menu costs: Inflation impacts on the prices charged by firms.

Catalogues, price lists and menus have to be updated regularly and this is costly to businesses. Of course, workers also have to be paid for the time they take to reprice goods and services.

Shoe leather costs:

Inflation causes fluctuations in price levels, so customers spend more time searching for the best deals.

Fall in purchasing power.

As the cost of living increases, consumers need more money to buy the same amount of goods and services. Consumer confidence may be damaged due to uncertainty in the future prices of goods and services. Employees will push for higher pay rises, in order to match price rises.

The potential benefits of inflation include:

Stimulating output:

A low and stable inflation rate caused by increasing demand may make firms feel optimistic about the future. In addition, if prices rise by more than costs, profits will increase, which will provide funds for investment.

Reduce the burden of debt:

Real interest rates may fall due to inflation or may even become negative. This is because nominal interest rates do not tend to rise in line with inflation. As a result, debt burdens may fall.

For example, those who have borrowed money to buy a house may experience a fall in their mortgage payments in real terms.

A reduction in the debt burden may stimulate consumer expenditure

This could lead to higher output and employment.

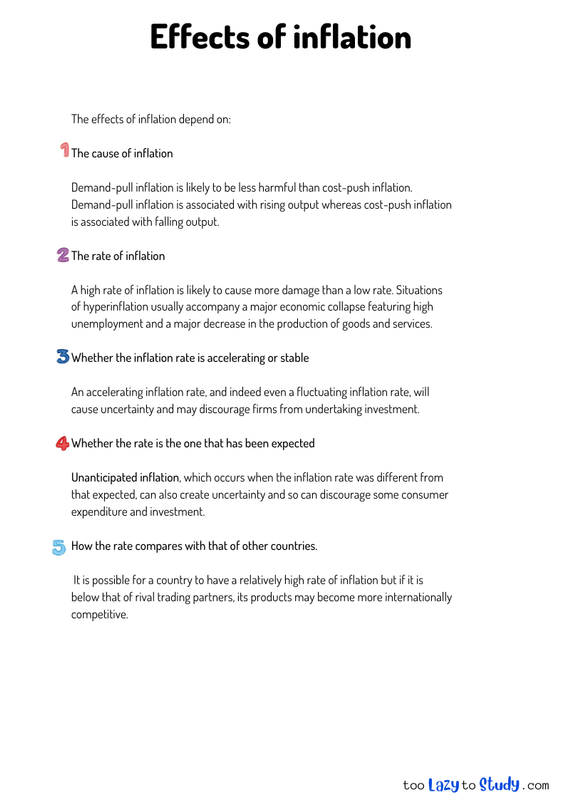

The effects of inflation depend on:

The cause of inflation

Demand-pull inflation is likely to be less harmful than cost-push inflation. Demand-pull inflation is associated with rising output whereas cost-push inflation is associated with falling output.

The rate of inflation

A high rate of inflation is likely to cause more damage than a low rate. Situations of hyperinflation usually accompany a major economic collapse featuring high unemployment and a major decrease in the production of goods and services.

Whether the inflation rate is accelerating or stable

An accelerating inflation rate, and indeed even a fluctuating inflation rate, will cause uncertainty and may discourage firms from undertaking investment.

Whether the rate is the one that has been expected

Unanticipated inflation, which occurs when the inflation rate was different from that expected, can also create uncertainty and so can discourage some consumer expenditure and investment.

How the rate compares with that of other countries.

It is possible for a country to have a relatively high rate of inflation but if it is below that of rival trading partners, its products may become more internationally competitive.

.png)

Economics notes on

Effects of inflation

Perfect for A level, GCSEs and O levels!