Overview

A government may try to keep the exchange rate at a fixed level against a major currency such as the US dollar, or may try to keep it within a specified value range.

Fixed exchange rates involves publishing the target parity against a single currency (or a basket of currencies), and a commitment to use monetary policy (interest rates) and official reserves of foreign exchange to hold the actual spot rate within some trading band around this target.

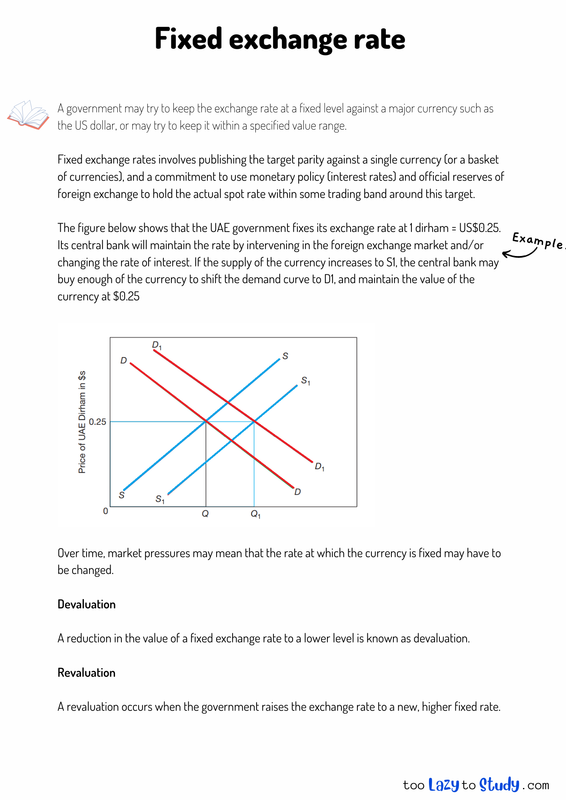

The figure below shows that the UAE government fixes its exchange rate at 1 dirham = US$0.25. Its central bank will maintain the rate by intervening in the foreign exchange market and/or changing the rate of interest. If the supply of the currency increases to S1, the central bank may buy enough of the currency to shift the demand curve to D1, and maintain the value of the currency at $0.25

Over time, market pressures may mean that the rate at which the currency is fixed may have to be changed.

Devaluation

A reduction in the value of a fixed exchange rate to a lower level is known as devaluation.

Revaluation

A revaluation occurs when the government raises the exchange rate to a new, higher fixed rate.

.png)

Economics notes on

Fixed exchange rate

Perfect for A level, GCSEs and O levels!