Overview

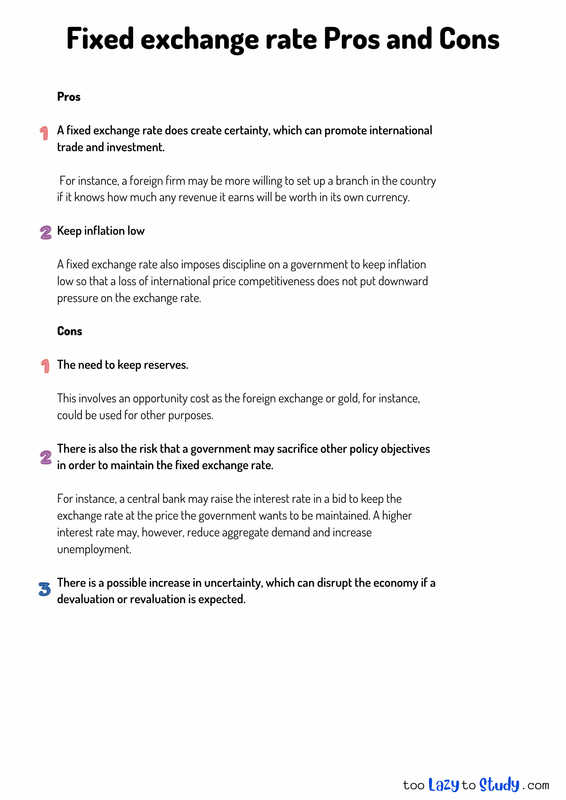

Pros

A fixed exchange rate does create certainty, which can promote international trade and investment.

For instance, a foreign firm may be more willing to set up a branch in the country if it knows how much any revenue it earns will be worth in its own currency.

Keep inflation low

A fixed exchange rate also imposes discipline on a government to keep inflation low so that a loss of international price competitiveness does not put downward pressure on the exchange rate.

Cons

The need to keep reserves.

This involves an opportunity cost as the foreign exchange or gold, for instance, could be used for other purposes.

There is also the risk that a government may sacrifice other policy objectives in order to maintain the fixed exchange rate.

For instance, a central bank may raise the interest rate in a bid to keep the exchange rate at the price the government wants to be maintained. A higher interest rate may, however, reduce aggregate demand and increase unemployment.

There is a possible increase in uncertainty, which can disrupt the economy if a devaluation or revaluation is expected.

.png)

Economics notes on

Fixed exchange rate pros and cons

Perfect for A level, GCSEs and O levels!