Overview

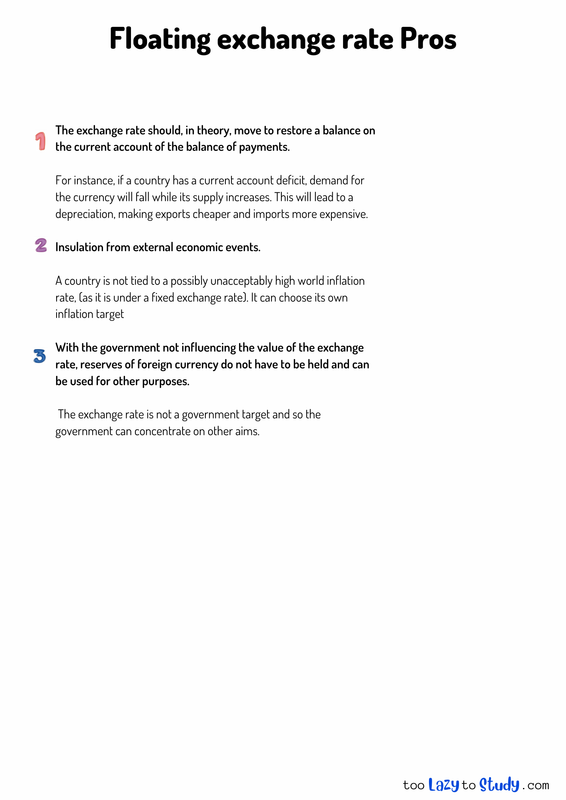

The exchange rate should, in theory, move to restore a balance on the current account of the balance of payments.

For instance, if a country has a current account deficit, demand for the currency will fall while its supply increases. This will lead to a depreciation, making exports cheaper and imports more expensive.

Insulation from external economic events.

A country is not tied to a possibly unacceptably high world inflation rate, (as it is under a fixed exchange rate). It can choose its own inflation target

With the government not influencing the value of the exchange rate, reserves of foreign currency do not have to be held and can be used for other purposes.

The exchange rate is not a government target and so the government can concentrate on other aims.

.png)

Economics notes on

Floating exchange rate Pros

Perfect for A level, GCSEs and O levels!