Overview

Taxes

A tax is a levy or charge imposed by a government to raise costs of production and to reduce consumption of certain goods or services.

Purpose

Taxation has several functions.

To raise revenues for the Government as well as for local authorities

To cause certain products to be priced to take into account their social costs. Taxes raise the costs of production and therefore can limit the output of certain demerit products, such as alcohol and tobacco.

To redistribute income and wealth in the economy.

To protect industries from foreign competition. Tariffs imposed on foreign goods and services help to protect domestic firms from overseas rivals.

Tax burden

The tax burden is the amount of tax that households and firms have to pay.

Canons of taxation

A ‘good’ tax is one that is:

equitable – those who can afford to should pay more

economic – the revenue should be greater than the costs of collection

transparent – taxpayers should know exactly what they are paying

convenient – it should be easy to pay

Types of tax

Direct taxes

Direct taxes are paid directly to the government by taxpayers, either as individuals or companies, from their incomes.

Example:

income tax

corporation tax on the profits of businesses

national insurance contributions paid by employers and employees.

Governments can use direct taxes (imposed on income, wealth or profits) to reduce income inequalities in the economy.

Indirect taxes

Indirect taxes are collected for the government by retailers and local government bodies.

Example:

value-added tax (VAT) on the retail sales of many goods and services

excise duties on fuel, alcohol and tobacco products

council tax

business rates charged locally on the ownership of houses, apartments and business premises

Governments can use indirect taxation (imposed on spending) to affect consumer expenditure.

Governments can also impose tariffs (import taxes) to discourage the purchase of foreign goods and services in order to protect domestic businesses and jobs.

Incidence of tax

Incidence of tax is the distribution of the burden of tax between sellers and buyers.

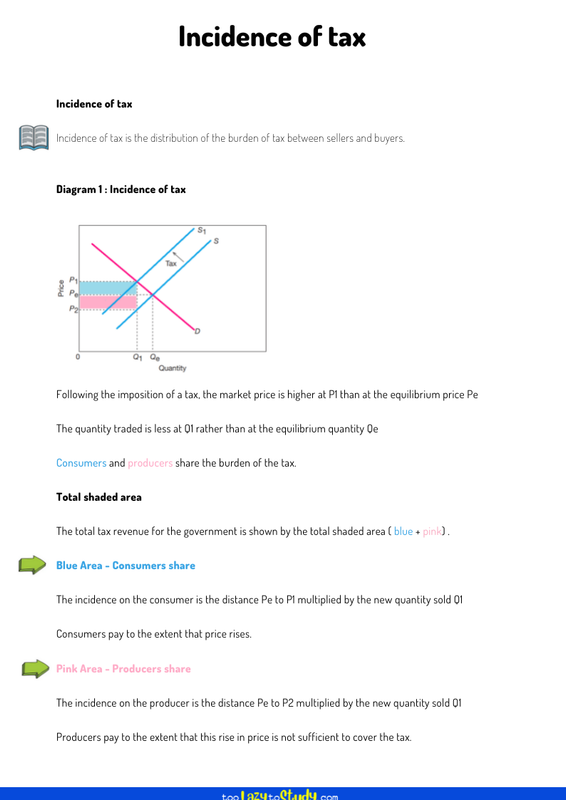

Diagram 1 : Incidence of tax

Following the imposition of a tax, the market price is higher at P1 than at the equilibrium price Pe

The quantity traded is less at Q1 rather than at the equilibrium quantity Qe

Consumers and producers share the burden of the tax.

Total shaded area

The total tax revenue for the government is shown by the total shaded area ( blue + pink) .

Blue Area - Consumers share

The incidence on the consumer is the distance Pe to P1 multiplied by the new quantity sold Q1

Consumers pay to the extent that price rises.

Pink Area - Producers share

The incidence on the producer is the distance Pe to P2 multiplied by the new quantity sold Q1

Producers pay to the extent that this rise in price is not sufficient to cover the tax.

.png)

Economics notes on

Incidence of tax

Perfect for A level, GCSEs and O levels!