Overview

Incidence of tax and elasticity

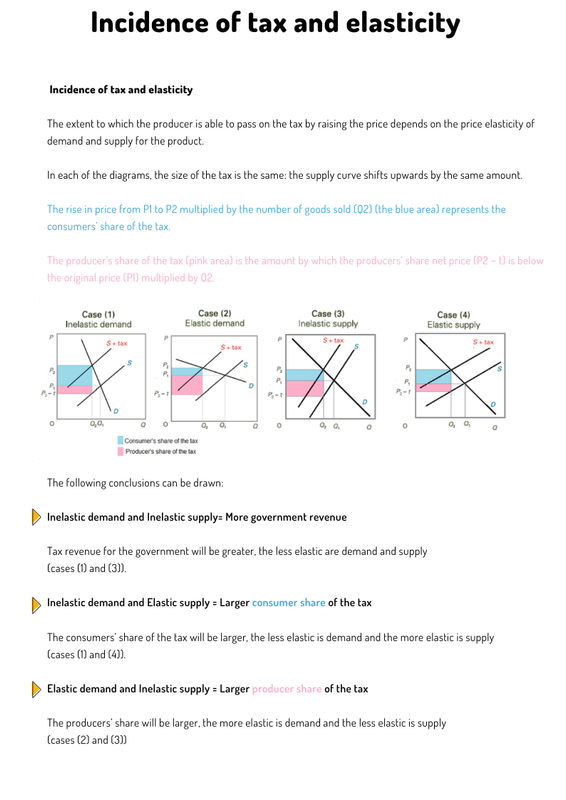

The extent to which the producer is able to pass on the tax by raising the price depends on the price elasticity of demand and supply for the product.

The following conclusions can be drawn:

Inelastic demand and Inelastic supply= More government revenue

Tax revenue for the government will be greater, the less elastic are demand and supply

(cases (1) and (3)).

Inelastic demand and Elastic supply = Larger consumer share of the tax

The consumers’ share of the tax will be larger, the less elastic is demand and the more elastic is supply

(cases (1) and (4)).

Elastic demand and Inelastic supply = Larger producer share of the tax

The producers’ share will be larger, the more elastic is demand and the less elastic is supply

(cases (2) and (3))

.png)

Economics notes on

Incidence of tax and elasticity

Perfect for A level, GCSEs and O levels!