Overview

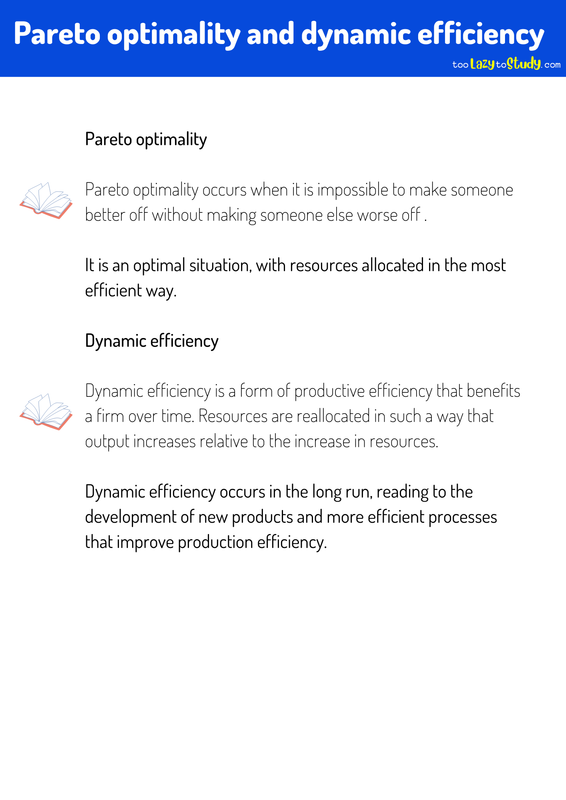

Pareto optimality

Pareto optimality occurs when it is impossible to make someone better off without making someone else worse off .

It is an optimal situation, with resources allocated in the most efficient way.

Pareto efficiency examples

Assume we are building a new airport and there are winners and losers.

The private and external benefits are predicted to be worth £20 billion.

The cost of constructing the airport is £13 billion.

Residents living nearby suffer a personal welfare cost of £1 billion (because of pollution and congestion)

Residents living nearby suffer a personal minus welfare cost of £1 billion (because of pollution and congestion) A substantial £6 billion gain

However, applying Pareto efficiency principles, this is not a Pareto improvement because individuals living close lose out.

What are our options? The scheme has a net welfare gain – but some people suffer the effects.

One possibility is to require the airport company to compensate nearby households for the inconvenience of missing out.

In this way, the airport goes ahead, and the company make a profit, but local residents are compensated for losing out.

Market failure and Pareto efficiency

In a free market, market failure is described as inefficient resource allocation. Market failure implies Pareto inefficiency – because it is possible to improve.

For example, the over-consumption of demerit goods (drugs/tobacco) leads to external costs to non-smokers and also early death for smokers. A tobacco tax could motivate people to quit smoking while also raising funds to treat smoking-related diseases.

Equality and Pareto efficiency

Although an outcome may be considered a Pareto improvement, this does not imply that it is desirable or fair. Even after a Pareto improvement, there may still be inequality.

A society can have Pareto efficiency but also high levels of inequality. Assume you have a pie and three people; the most equitable solution would be to divide it into three equal portions. However, if it was sliced in half and shared by two individuals, it would be considered Pareto efficient – because the third person does not lose out – (despite the fact that he does not share in the pie).

More elements, such as social efficiency, total welfare, and issues such as diminishing marginal utility of money, must be considered while making judgments.

Dynamic efficiency

Dynamic efficiency is a form of productive efficiency that benefits a firm over time. Resources are reallocated in such a way that output increases relative to the increase in resources.

Dynamic efficiency occurs in the long run, reading to the development of new products and more efficient processes that improve production efficiency.

Factors influencing dynamic efficiency

Investment in new technology and enhanced capital can result in lower costs in the future state of technology. Rapid technological advancements can enable businesses to produce more at reduced costs.

Workers' and managers' motivation - do managers have incentives to take chances and innovate, or is the firm's structure designed to foster stagnant development?

Access to finance. A company that does not have access to funding will find it difficult to invest in new capital.

.png)

Economics notes on

Pareto optimality and dynamic efficiency

Perfect for A level, GCSEs and O levels!