Economics explained

Category:

Market failure

Government intervention and negative consumption externalities

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

Legislation

Legislation is also widely used in situations of negative consumption externalities. In the case of individuals, it is illegal to drive when drunk. Drunk driving imposes costs on others in the form of accidents and death.

Ban

The banning of smoking in public places is an example.

Information

The provision of information is also appropriate in this case of market failure. For example, raising awareness about the dangers of smoking.

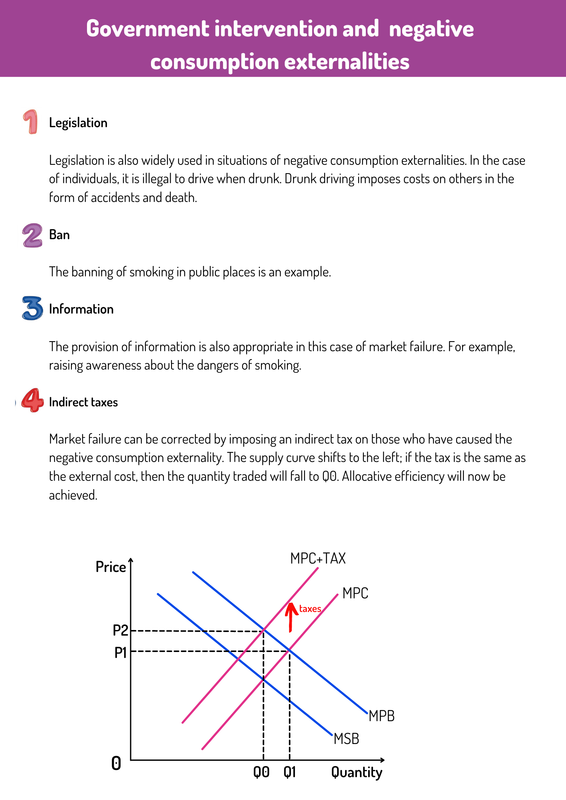

Indirect taxes

Market failure can be corrected by imposing an indirect tax on those who have caused the negative consumption externality. The supply curve shifts to the left; if the tax is the same as the external cost, then the quantity traded will fall to Q0. Allocative efficiency will now be achieved.