Economics explained

Category:

microeconomic policies

Incidence of tax

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

Incidence of tax

Incidence of tax is the distribution of the burden of tax between sellers and buyers.

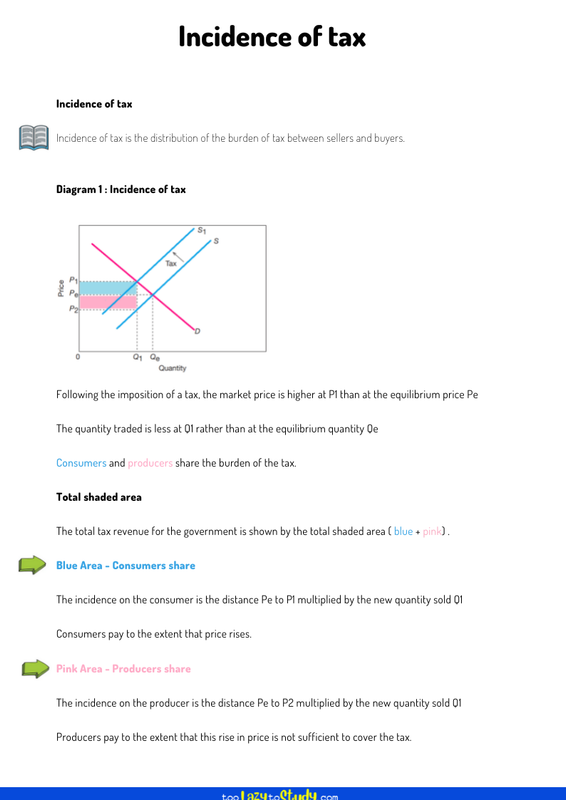

Diagram 1 : Incidence of tax

Following the imposition of a tax, the market price is higher at P1 than at the equilibrium price Pe

The quantity traded is less at Q1 rather than at the equilibrium quantity Qe

Consumers and producers share the burden of the tax.

Total shaded area

The total tax revenue for the government is shown by the total shaded area ( blue + pink) .

Blue Area - Consumers share

The incidence on the consumer is the distance Pe to P1 multiplied by the new quantity sold Q1

Consumers pay to the extent that price rises.

Pink Area - Producers share

The incidence on the producer is the distance Pe to P2 multiplied by the new quantity sold Q1

Producers pay to the extent that this rise in price is not sufficient to cover the tax.