top of page

Economics explained

Category:

International trade

Tariffs

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

A tariff is a tax on imports.

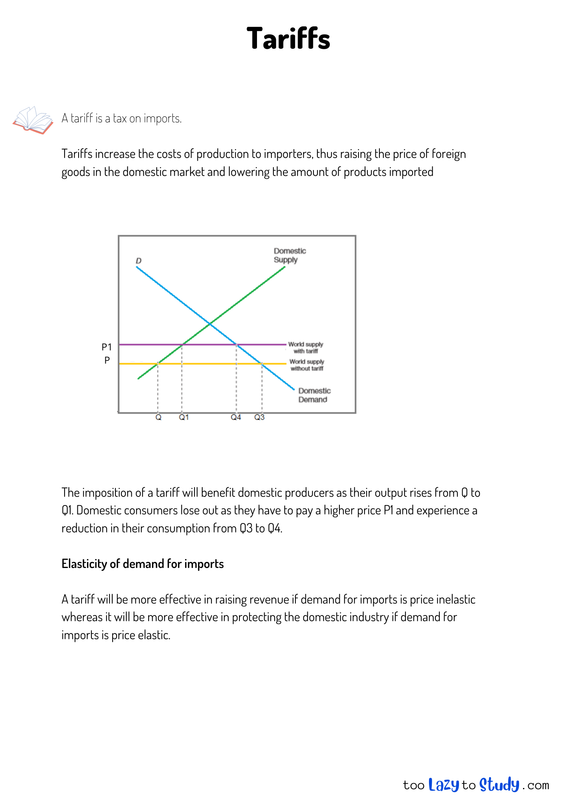

Tariffs increase the costs of production to importers, thus raising the price of foreign goods in the domestic market and lowering the amount of products imported

The imposition of a tariff will benefit domestic producers as their output rises from Q to Q1. Domestic consumers lose out as they have to pay a higher price P1 and experience a reduction in their consumption from Q3 to Q4.

Elasticity of demand for imports

A tariff will be more effective in raising revenue if demand for imports is price inelastic whereas it will be more effective in protecting the domestic industry if demand for imports is price elastic.

bottom of page