Economics explained

Category:

Inflation and deflation

The consequences of inflation

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

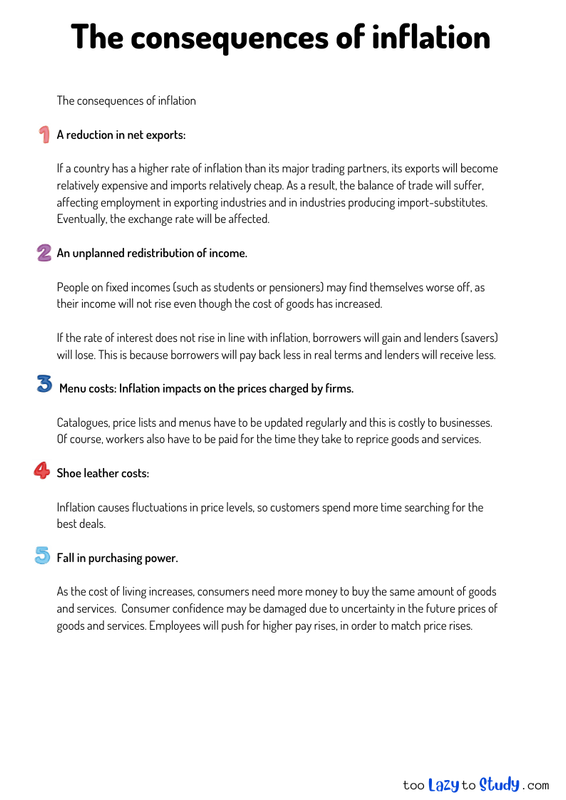

The consequences of inflation

A reduction in net exports:

If a country has a higher rate of inflation than its major trading partners, its exports will become relatively expensive and imports relatively cheap. As a result, the balance of trade will suffer, affecting employment in exporting industries and in industries producing import-substitutes. Eventually, the exchange rate will be affected.

An unplanned redistribution of income.

People on fixed incomes (such as students or pensioners) may find themselves worse off, as their income will not rise even though the cost of goods has increased.

If the rate of interest does not rise in line with inflation, borrowers will gain and lenders (savers) will lose. This is because borrowers will pay back less in real terms and lenders will receive less.

Menu costs: Inflation impacts on the prices charged by firms.

Catalogues, price lists and menus have to be updated regularly and this is costly to businesses. Of course, workers also have to be paid for the time they take to reprice goods and services.

Shoe leather costs:

Inflation causes fluctuations in price levels, so customers spend more time searching for the best deals.

Fall in purchasing power.

As the cost of living increases, consumers need more money to buy the same amount of goods and services. Consumer confidence may be damaged due to uncertainty in the future prices of goods and services. Employees will push for higher pay rises, in order to match price rises.