Economics explained

Category:

microeconomic policies

The impact of taxation

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

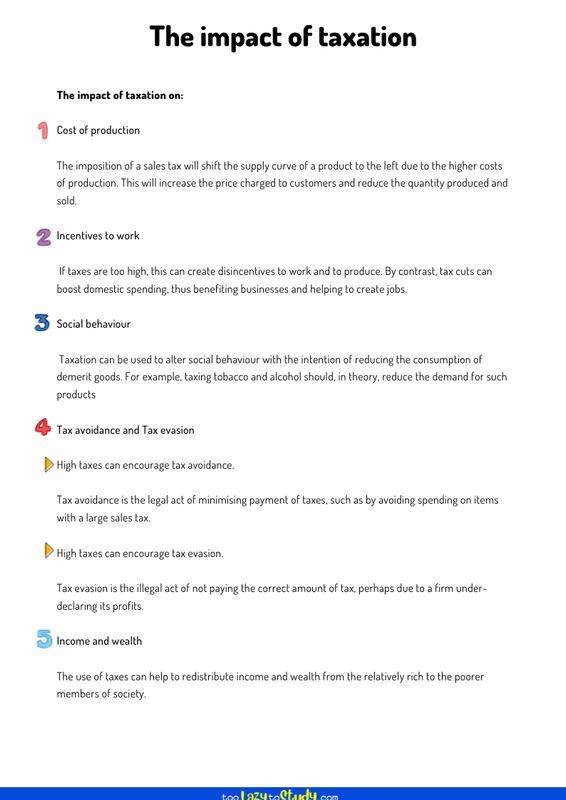

The impact of taxation on:

Cost of production

The imposition of a sales tax will shift the supply curve of a product to the left due to the higher costs of production. This will increase the price charged to customers and reduce the quantity produced and sold.

Incentives to work

If taxes are too high, this can create disincentives to work and to produce. By contrast, tax cuts can boost domestic spending, thus benefiting businesses and helping to create jobs.

Social behaviour

Taxation can be used to alter social behaviour with the intention of reducing the consumption of demerit goods. For example, taxing tobacco and alcohol should, in theory, reduce the demand for such products

Tax avoidance and Tax evasion

High taxes can encourage tax avoidance.

Tax avoidance is the legal act of minimising payment of taxes, such as by avoiding spending on items with a large sales tax.

High taxes can encourage tax evasion.

Tax evasion is the illegal act of not paying the correct amount of tax, perhaps due to a firm under-declaring its profits.

Income and wealth

The use of taxes can help to redistribute income and wealth from the relatively rich to the poorer members of society.