Economics explained

Category:

microeconomic policies

Types of tax

The secret to scoring awesome grades in economics is to have corresponding awesome notes.

A common pitfall for students is to lose themselves in a sea of notes: personal notes, teacher notes, online notes textbooks, etc... This happens when one has too many sources to revise from! Why not solve this problem by having one reliable source of notes? This is where we can help.

What makes TooLazyToStudy notes different?

Our notes:

-

are clear and concise and relevant

-

is set in an engaging template to facilitate memorisation

-

cover all the important topics in the O level, AS level and A level syllabus

-

are editable, feel free to make additions or to rephrase sentences in your own words!

Looking for live explanations of these notes? Enrol now for FREE tuition!

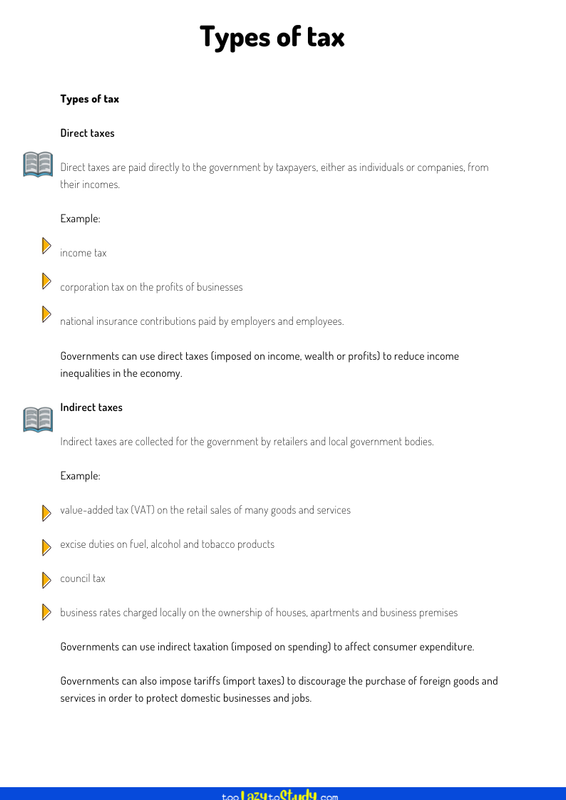

Types of tax

Direct taxes

Direct taxes are paid directly to the government by taxpayers, either as individuals or companies, from their incomes.

Example:

income tax

corporation tax on the profits of businesses

national insurance contributions paid by employers and employees.

Governments can use direct taxes (imposed on income, wealth or profits) to reduce income inequalities in the economy.

Indirect taxes

Indirect taxes are collected for the government by retailers and local government bodies.

Example:

value-added tax (VAT) on the retail sales of many goods and services

excise duties on fuel, alcohol and tobacco products

council tax

business rates charged locally on the ownership of houses, apartments and business premises

Governments can use indirect taxation (imposed on spending) to affect consumer expenditure.

Governments can also impose tariffs (import taxes) to discourage the purchase of foreign goods and services in order to protect domestic businesses and jobs.